Commercial amortization schedule 360 day year

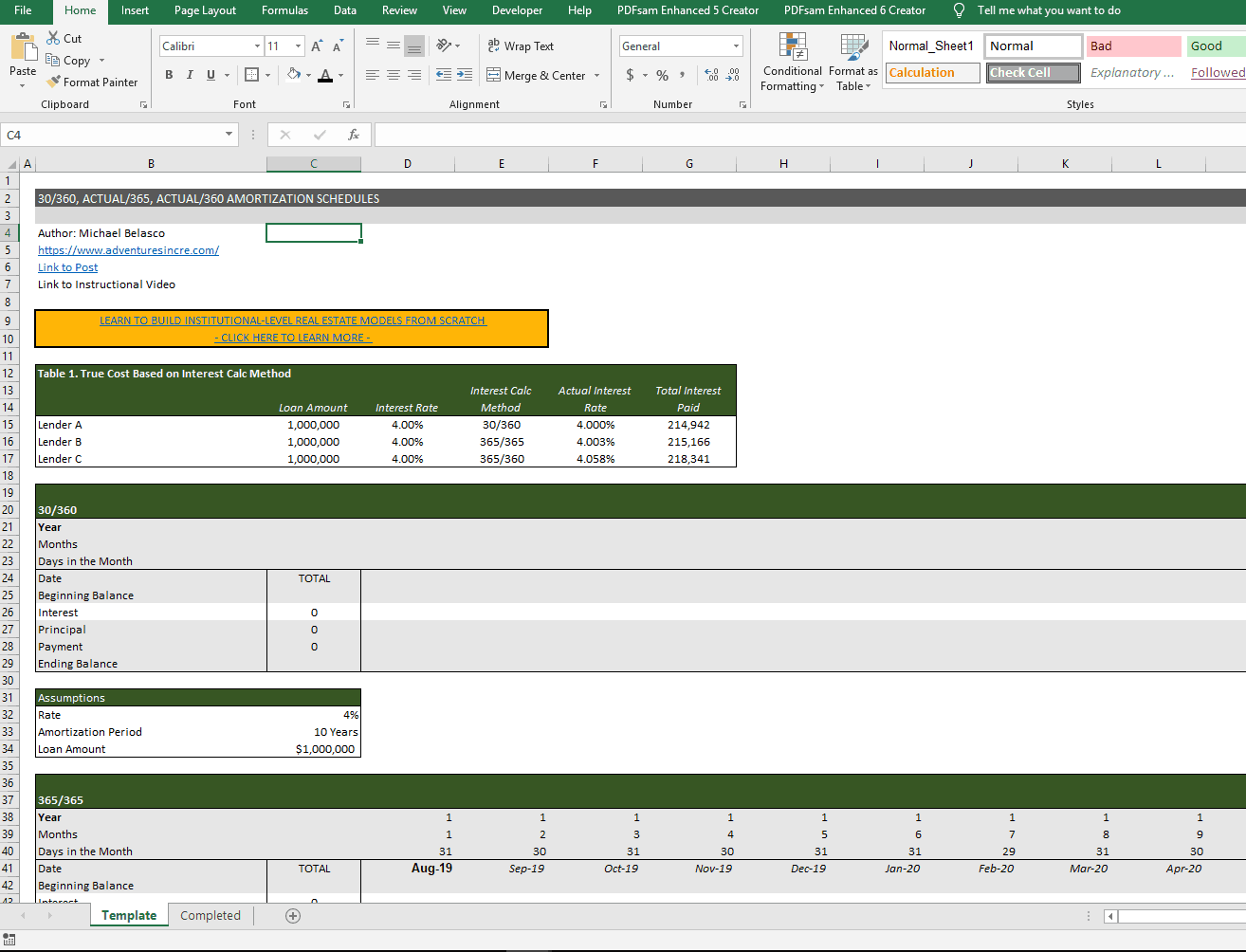

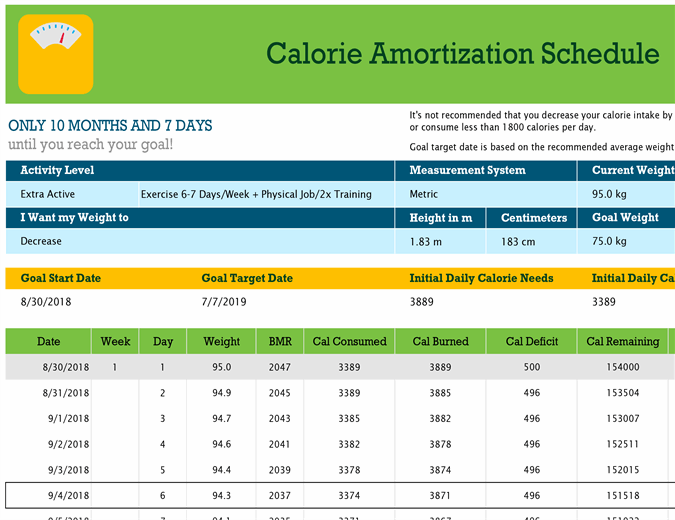

If you truly mean 360365 the annual rate would be converted to a daily rate based on 365 days per year. How to Calculate Monthly Payments for Commercial Loans.

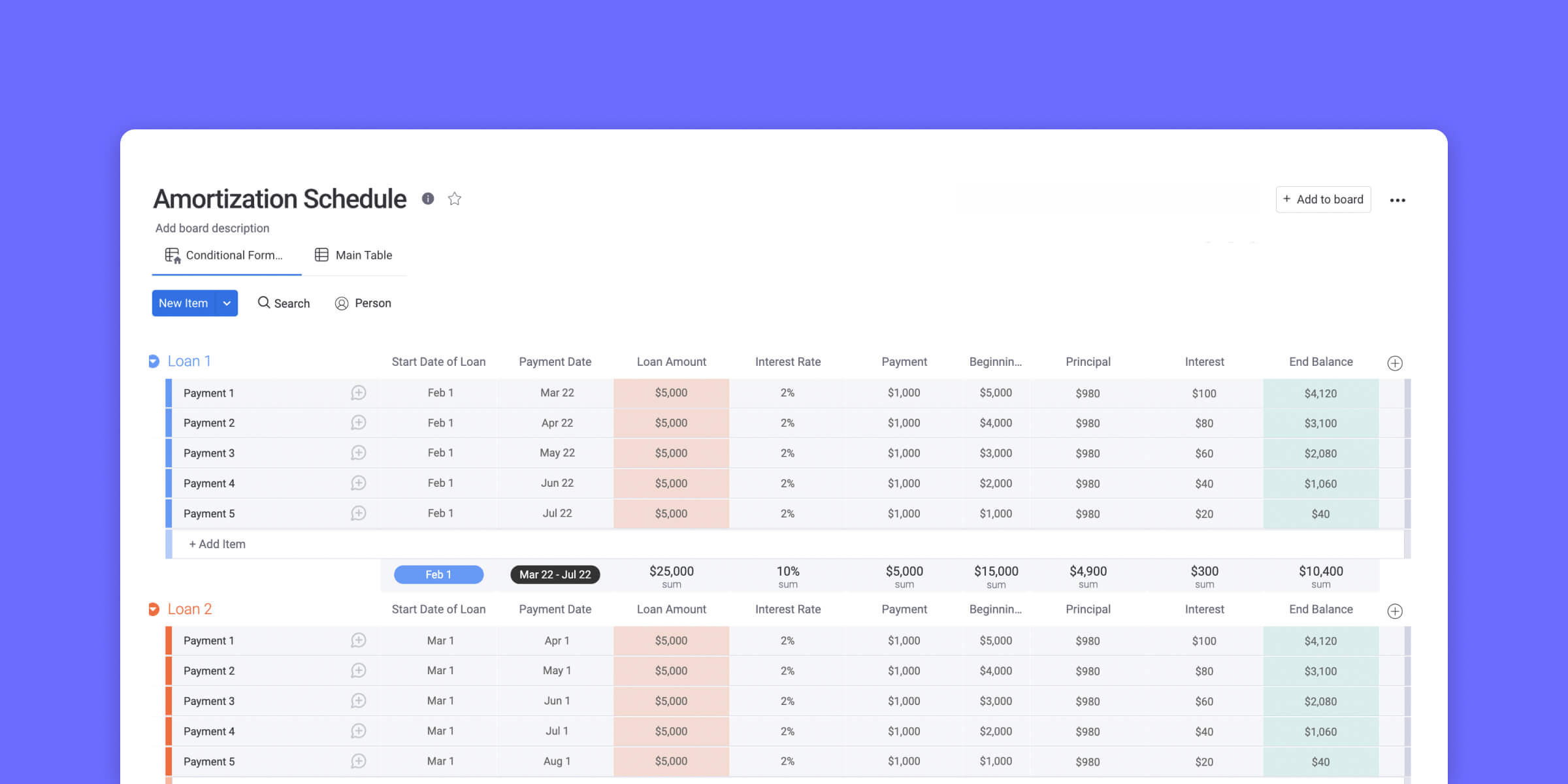

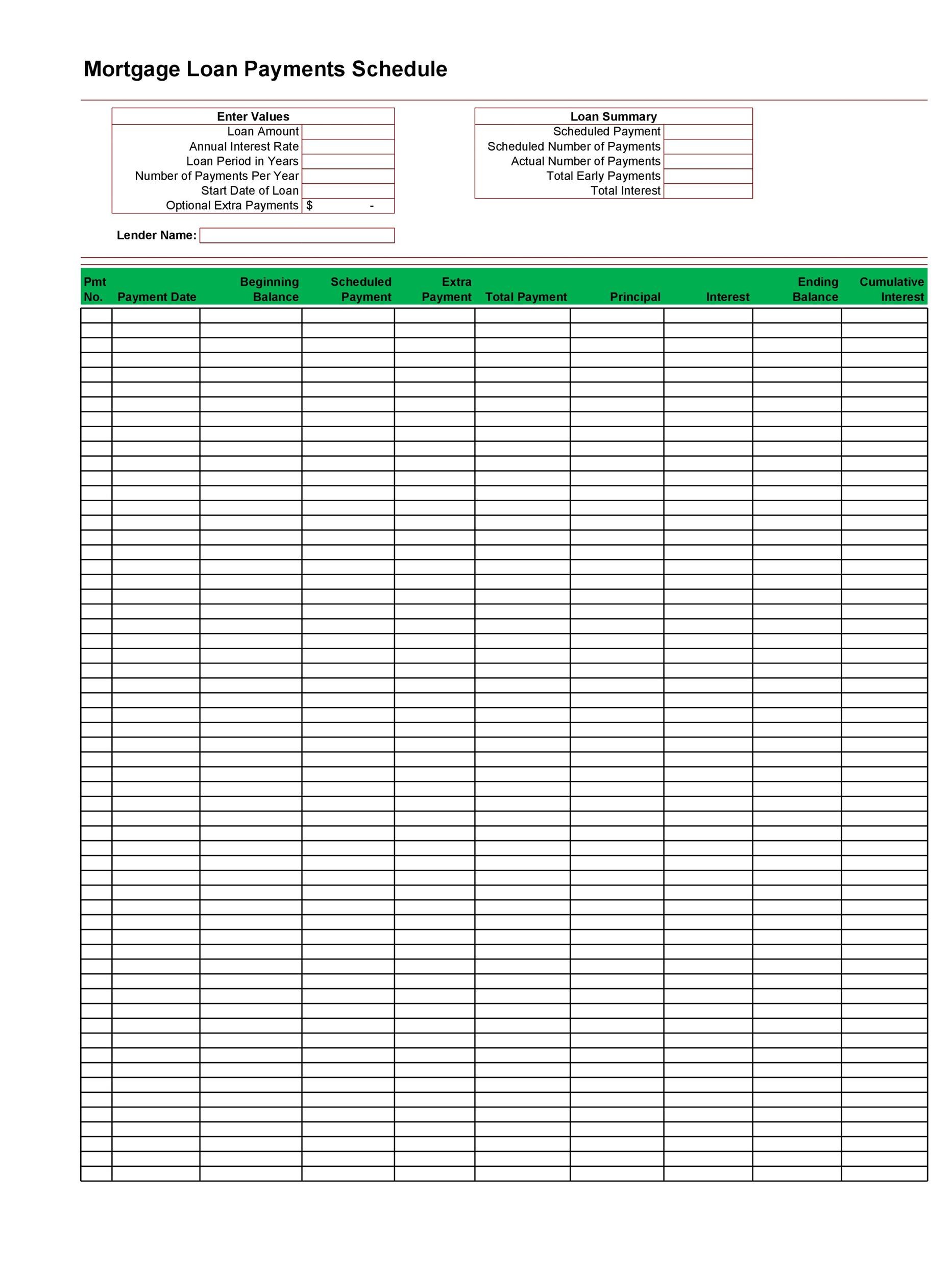

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Methods for Calculating Interest on Loans.

. 365360 US Rule Methodology For most commercial loans interest is calculated using a daily rate based on a 360 day year. On day 360 of the Bank Method with 5 days remaining in the actual year still to be paid. If you dont know the origination fee put in 5 of your requested loan amount to be on the safe side.

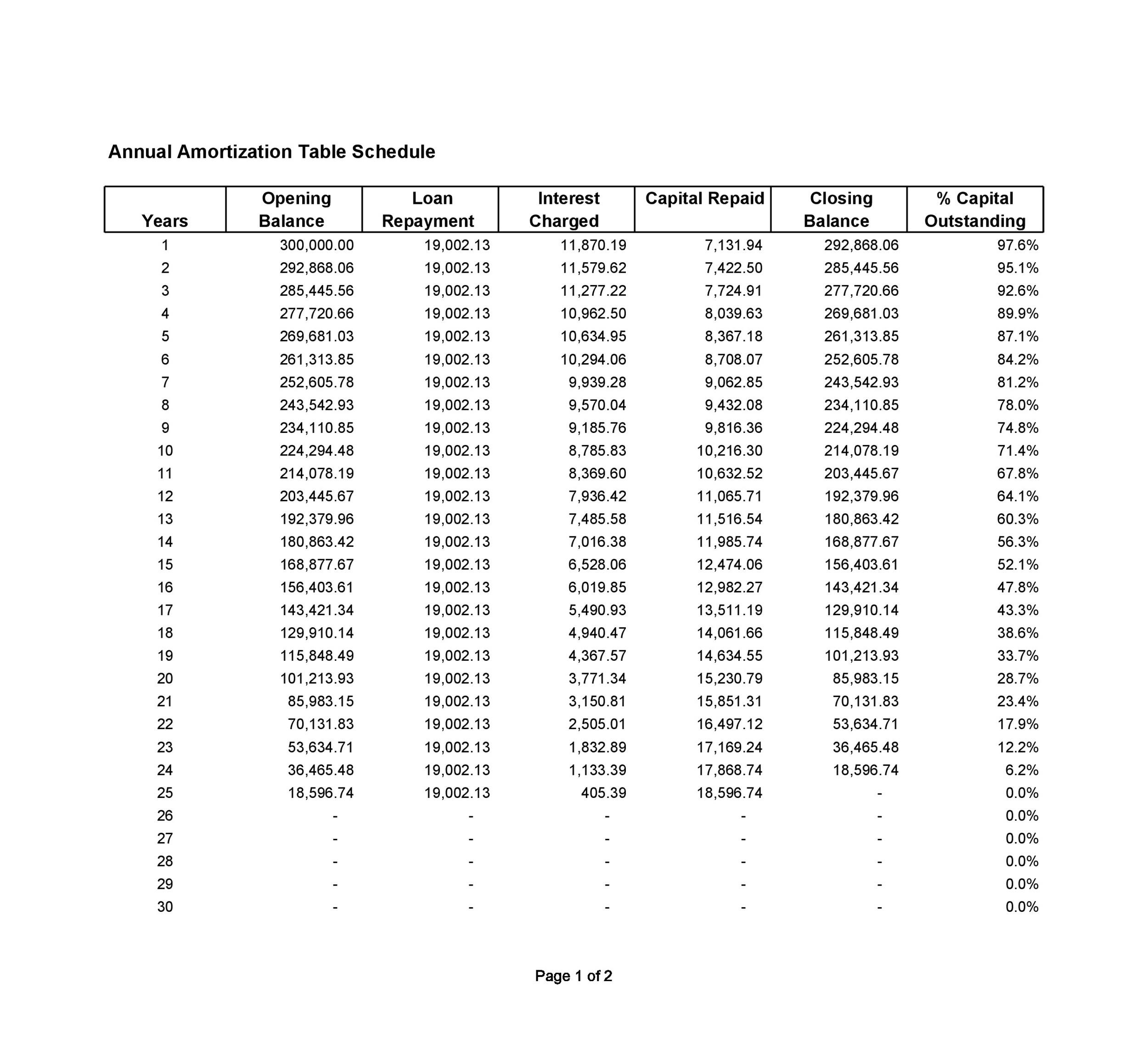

The payment structure follows a full amortization schedule where you. If your debt service coverage is greater than 125 including your new. Loan Amortization for randomirregular payments figures days Some banks use a 360 day year for compounding purposes.

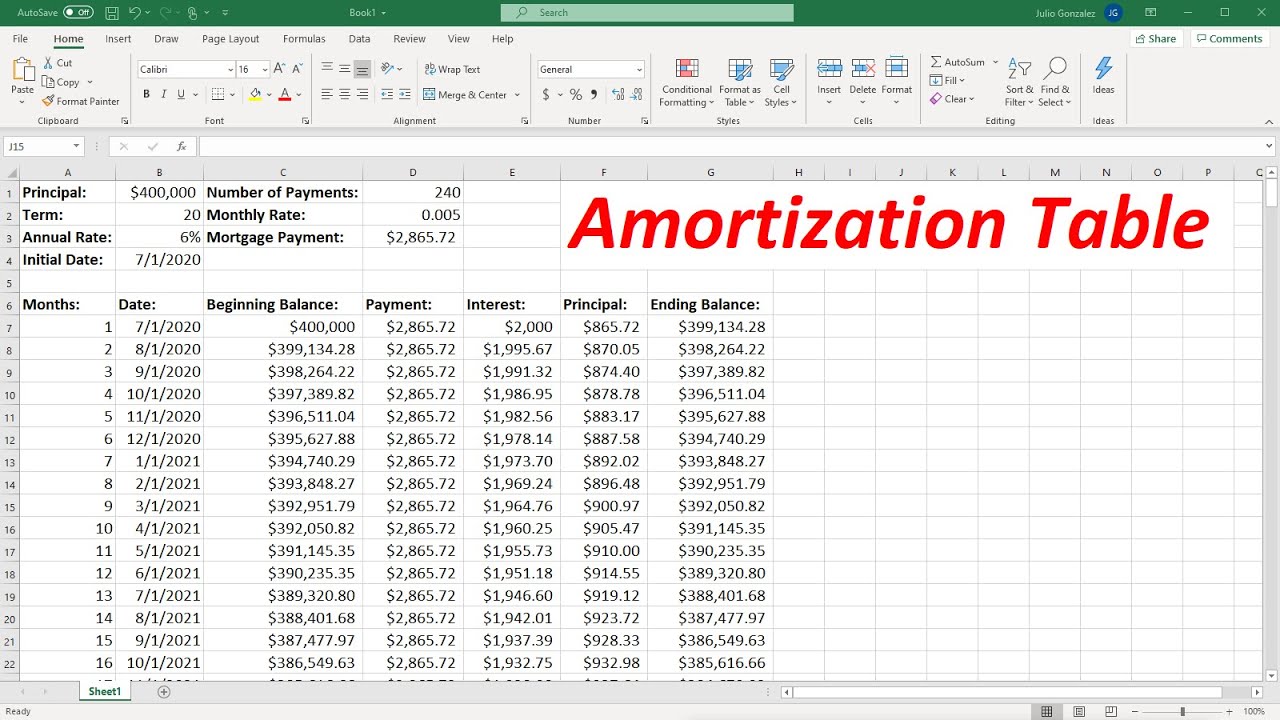

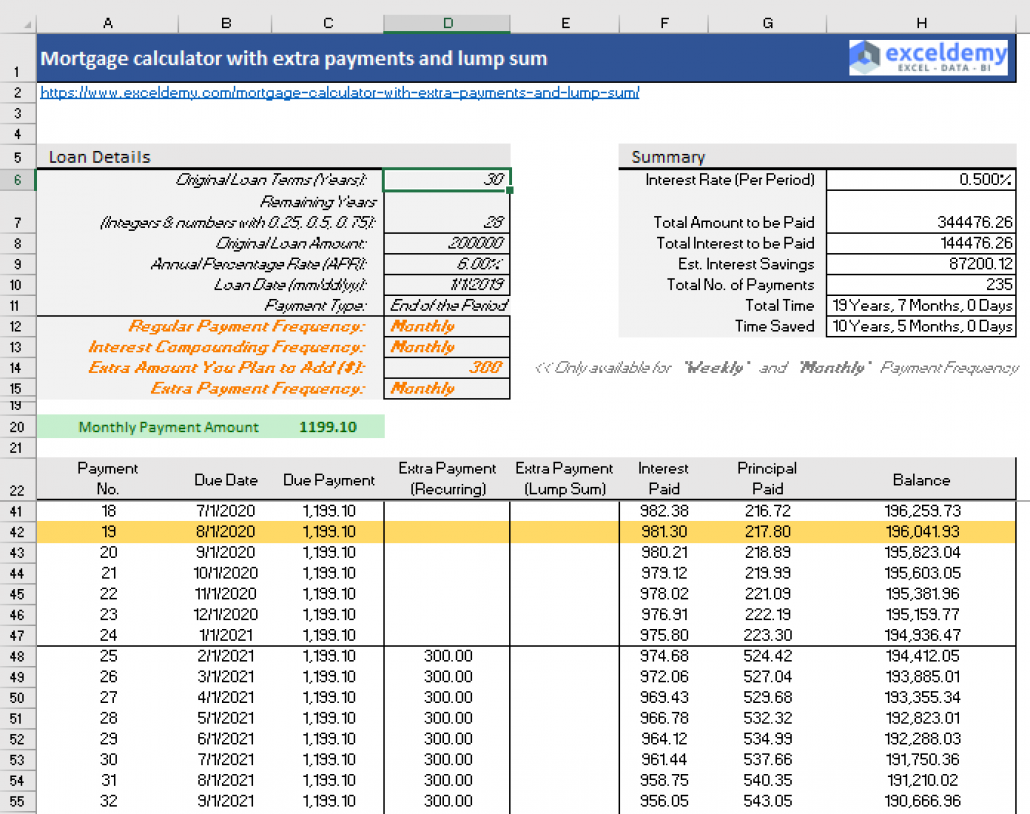

Learn more how to use 365360 Loan Calculator. Annual interest rate for this loan. Use the formula in the image below to calculate the monthly payment for a commercial loan.

Banks most commonly use the 365360 calculation method for commercial loans to standardize the daily interest rates based on a 30-day month. 1 To calculate the interest payment under the. Use this calculator to estimate your debt service coverage with a new commercial loan.

Put the dollar amount in this field of the business loan calculator. This free home mortgage mortgage features a flexible amortization schedule that allows the user to use the 30360 actual365 or. If your financial institution.

Interest is calculated monthly at 1360th of the annual rate times the number of days in the month on the current outstanding balance of your loan. Now I can get pretty close to your banks payment with 16360 36512-1 as. Either annualRate365 or 1annualRate1365-1.

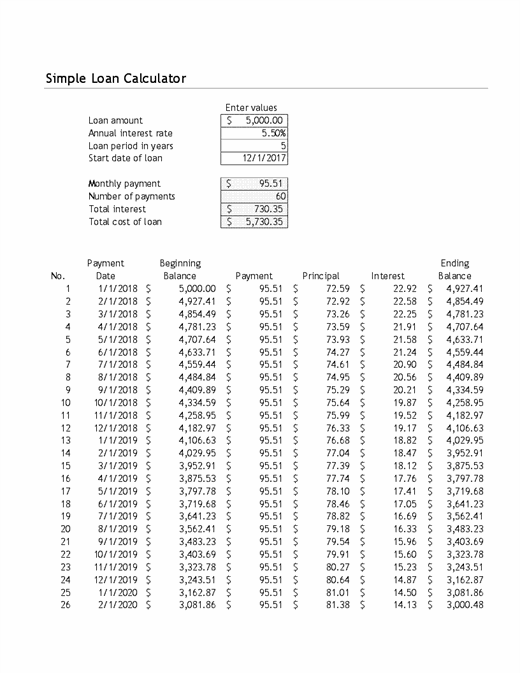

Most relevant amortization schedule 360 day year websites. This loan calculator also known as an amortization schedule calculator lets you estimate your monthly loan repayments. The formula would look something like this.

Find the term of the loan lets say 360 months or 30 years The. If you have a loan with a payment frequency of. Based on a 360 day year with traditional.

According to MyFICO residential mortgage rates in February 2020 range from 315 percent to 474 percent. Your banks payment is equivalent to an AER of 6264. It assumes a 360-day year and the date you enter for the Loan Date is one day.

If using excel you can calculate the. Interest is calculated monthly at 1360th of the annual rate times the number of days in the month on the current outstanding balance of your. This process is applied to every month of the amortization period.

The first one lets you create an estimated amortization schedule for a daily. Use this calculator to create an.

How To Create An Amortization Table In Excel Youtube

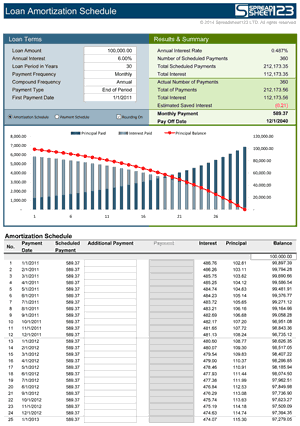

Amortization Schedule Create Accurate Payment Schedules

Adding An Interest Only Period To An Amortization Schedule 1 Of 2 Youtube

Easy To Use Amortization Schedule Excel Template Monday Com Blog

/amortizationschedule_definition_final_0804-4e9f8d46da6148d5b68ecb4acaf88c8d.png)

What Is An Amortization Schedule How To Calculate With Formula

Watch Me Build 30 360 Actual 365 And Actual 360 Amortization Tables Template And Completed Modules Adventures In Cre

The New Homeowner S Guide To Mortgage Amortization

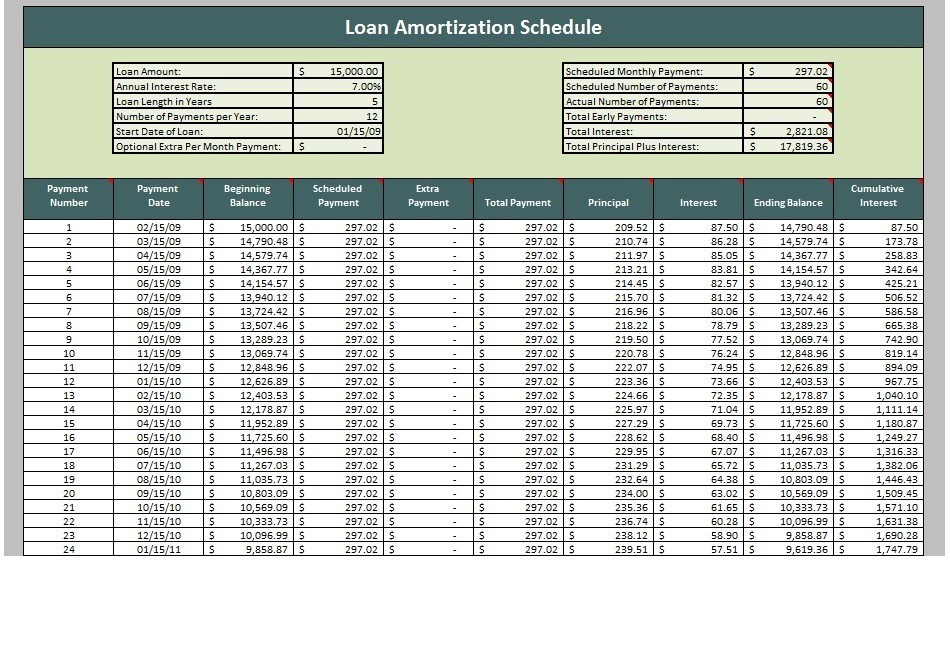

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Easy To Use Amortization Schedule Excel Template Monday Com Blog

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Loan Amortization Schedule Calculator Home Mortgage Calculator College Loan Calculator Car Loan Calculator Pay Off Mortgage Pay Off Loan

The New Homeowner S Guide To Mortgage Amortization

Easy To Use Amortization Schedule Excel Template Monday Com Blog

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Easy To Use Amortization Schedule Excel Template Monday Com Blog

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab